3 Forms of Business Organisation in Business Studies

A business undertaking is an institutional arrangement to conduct any type of business activity. The undertaking may be run by one person or association of persons. It may be based on formal or informal agreement among persons who undertake to run the concerns.

According to Wheeler, a business undertaking is a concern, company or enterprise which buys and sells, is owned by one person a group of persons and in managed under a specific set of operating policies. The persons join together and pool their resources and conduct the activities of the undertaking for the benefit of all.

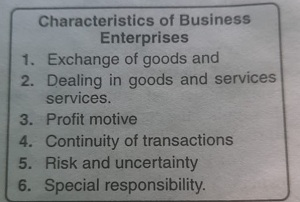

CHARACTERISTICS OF FORMS OF ORGANISATIONS

The essential characteristics of business organisations are given as follows:

1. Exchange of Goods and Services. A business enterprises deals in exchange of goods and services. The goods to be exchanged may either be produced or procured from other sources. The is generally for money or money’s worth.

2. Dealing in Goods and Services. All business undertakings deal in goods and services. The goods may be consumers goods or producers goods. The consumers goods are those which are purchased by them for consumption or day-to-day use.

These goods include food products, clothes, tooth paste, soap, etc. The producers goods are those which are meant for further use in production. These goods may be machines, plants, tools, equipment’s, etc. The services, on the other hand, may be water supply, electricity supply, transport facilities etc.

3. Profit motive. All business undertakings are run to earn profits. An undertaking started for social service will not be called business undertaking because the aim is not to earn profit. The incentive of earning profit keeps undertaking going. The aim is to get back more than what has been invested

4. Continuity of Transactions. The transactions in a business undertaking are continuous or regular. They are engaged in a series of successive transactions over time and space.

5. Risk and Uncertainty. Every business undertaking is exposed to risks and influenced by future events and future is always uncertain. There are chances of price fluctuations, demand changes, consumer likings and dislikings, etc. There may be a fire, earthquake, strike by workers etc. All these factors make a business undertaking risky and uncertain.

6. Social Responsibility. The only aim of business undertakings is not to increase profit. They own some responsibility to the society also. The society expected business undertaking to provide cheap and better quality goods to the consumers.

They are also expected to contribute towards social amenities by opening schools, hospitals, parks etc not only for the employees but also for people living these wastes by open a wood costs, parks, etc, not only for the employees but also for people living in those localities. Business undertakings should also avoid water and air pollution by these wastes.

3 Forms of Business Organization with Example

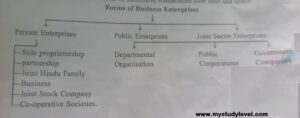

A number of forms of organisations exist to suit requirements of different business u There are three types of business undertakings.

1. Private Enterprises

2. Public Enterprises

3. Joint Sector Enterprises

Private Undertakings

These enterprises have the following types of organisation:

(i) Sole Proprietorship

(ii) Partnership

(iii) Joint Hindu Family Business

(iv) Joint Stock Company

(v) Co-operative Societies.

(1) Sole Proprietorship. The organisation is as old as civilisation. In this form of organisation a single individual promotes and controls the business undertakings and bears the whole risk himself. He supplies the entire capital for starting and running the business. He takes all the profits and bean all risks alone. This is the simple form of organisation requiring no formalities to set it up.

(ii) Partnership. A Partnership is an association of two or more persons to carry on, as to owners, a business and to share its profits and losses. The partnership may come into existence either as a result of the expansion of the trading concern or by means of an agreement between two or more persons desirous of forming a partnership.

This term of organisation grew essentially out of the failures and limitations of sole proprietorship. This represents the second stage in the evolution of the form of business organisation.

(iii) Joint Hindu Family Business. This form of organisation is prevalent only in India and that too among Hindus as the name is indicative. The business of Joint Hindu Family is controlled under the Hindu Law instead of Partnership Act.

The membership in this form can be acquired only be birth or by marriage to male person who is already a member of Joint Hindu Family. All the offices of the undertaking are controlled by a person known as Karta or manager.

(iv) Joint Stock Company. This form of organisation was first started in Italy in the thirteen century. A company is an association of many persons who contribute money or money’s worth to a common stock and employ it in some trade or business, and who share the profit and loss arising therefrom.

A company is an artificial person created by law with corporate personality, limited liability, perpetual succession and transferable shares. These undertakings are managed by elected representatives of shareholders. Companies may be public or private and registered by share or by guarantee.

(v) Co-operative Societies. Co-operative societies are voluntary associations started with the aim of service to members. The aim of societies is not to increase profits as in other undertaking but service to members is their important goal.

It is a joint enterprise of those who are not financially strong and cannot stand on their legs and, therefore, come together not with a view to get profits but to overcome disability rising out of the want of adequate financial resources. Like joint stock companies, societies also enjoy the benefits of corporate personality, limited liability and perpetual succession.

The societies are registered under the Co-operative Societies Act, 1912 and bave more governmental control than other organisations in private sector.

Public Enterprises

Business enterprises owned or operated by public authorities are known as public or state undertakings. In these undertakings, either whole of most of the investment is done by the government.

The aim of these undertakings is to provide goods and services to the public at a reasonable rate though profit earning is not entirely excluded. These undertakings have the following forms of organisation:

(i) Departmental Organisation

(ii) Public Corporations

(iii) Government Companies.

(i) Departmental Organisation. Departmental form of organisation for managing state enterprises is the oldest form of organisation. In this form, the enterprise works as a part of govern and management is in the hands of civil servants. The Secretary of the Department acts as Chief Executive under the control and direction of Minister.

The Minister is accountable to Parliament for the working of the department. Departmental form of organisation is suitable for public utility services and strategic industries. In India, railways, post and telegraph, radio and television are working as government departments.

(1) Public Corporations. Public corporations are created by a special statue of a State or Central Government. A legislative act is passed by defining the sphere of work and mode of management or the undertakings. It is a separate legal entity created for a specific purpose. In India, the Reserve Bank of India, Bank of India, Industrial Finance Corporation are some of the corporations created by special act of parliament.

(ii) Government Companies. The company owned by Central and/or State Government is called a Government Company. Either whole of the capital or majority of the shares are owned by the government.

Government companies are registered both as public limited and private limited companies but the management with the government in both the cases. Government companies enjoy some privileges which are not available to non-government companies. No special statute is required to form government companies.

Joint Sector Enterprises

Joint sector is a form of partnership between the private sector and the Government where management will generally be in the hands of private sector and overall supervision will lie with the Board of Directors giving adequate representation to Government representatives.

According to the guidelines of the Central Government, the capital is to be shared as to State Government 26%. Private Enterprise 25% and Investing Public 49%. No single-private party shall be allowed to hold more than 25% of the paid-up capital without the permission of the Central Government. Joint Sector Undertakings ensure the use of development technology and resources of government and private sector.

Factors Influencing the Choice of Suitable Form of Organisation

1. Capital Requirement. The need for capital will depend upon the nature of business and scale of operators. A manufacturing concern may require more capital as compared to a retail shop. On the other hand, if scale of operations is large, then capital requirements will also be more.

After determining the capital needs, the form of organisation should be selected. The form of organisation should be such that it is able to provide required funds. A sole-trade business will be suitable if capital needs are less. A partnership concern may be able to meet the capital needs of a medium size unit.

A joint stock company will be suitable if capital requirements are large. A company will be able to raise outside fund also. A sole-trade concern and a partnership firm have limited capacities for raising funds. SO, capital requirements will be directly influence the choice of the organisation.

2. Liability. In a sole-trade and partnership business, the ability of owners is unlimited, their abilities are limited to the capital they have invested but their private property can also be assigned to meet business obligations. in case of company of the liability of shareholders is limited to the value of shares they have purchased.

The shareholders can be required to pay only the unpaid amount of shares they are The private property of shareholders is not liable for meeting business losses. When a business involves more risks than company form of organisation will be most suitable. The units involving less risk be as sole-trade partnership concerns. A company started as sole-trade of persons. The risk bearing capacity of a sole trader and partners will be limited.

3. Managerial Needs. Managerial and administrative requirements also affect the decision about form of organisation. When the concern is small and it caters to local needs only then o person will be enough to manage the business. Sole Proprietorship form of Organisation will be suitable for such a business.

If the business caters to more areas, then more persons will be needed to look after various business activities. Partnership form of organisation will be suitable for such enterprises. Then partners will be able to look after various functions. When a business is run on a large-scale basis, it will require the services of specialists to manage various departments.

The company form of organisation will be most suitable for such concerns. Neither a sole-trade concern not a partnership firm will afford to employ professionally qualified persons. Moreover, qualified persons will not like to join small scale concerns for lack of career opportunities.

4. Continuity. This is another factor influencing a decision about the form of ownership. If the concern is stable and there is no fear of discontinuity, it will attract more investment. The trained and qualified persons will like to join the concern. The company form of organisation is the only form which ensures stability and continuity. A sole-trade business may be closed after the death of its owner.

Any type of physical and financial problem will force the closure of a business. A partnership firm too does not have a permanent life. It may be dissolved for a number of reasons Only a company form of organisation will be unaffected by the personal life of its shareholders. A company form of organisation will be suitable if stability of operations is essential.

5. Tax Liability. A joint stock company has more tax liability as compared to a sole-trade business and a partnership firm. A joint stock company faces double taxation liability. A company is taxed as an individual first and the profits distributed to shareholders are again liable for tax as income of the recipients.

A partnership concern and a sole-trade business are not separately taxed A small-scale concern will be able to avoid higher tax liability.

6. Government Regulations. While deciding about the form of organisation, various kinds of rules and regulations affecting that form will also be considered. A number of formalities are required to be complied with while incorporating a company. A company is expected to provide a large number of information to the government every year.

It has to use the services of experts to meet statutory requirements of various laws. A sole-trade business is not expected to meet any legal requirements. Similarly, a partnership concern is also free from government regulations. Even the registration of a firm is not compulsory.

7. Nature of Business Activities. The nature of business is another important factor affecting a decision about the form of organisation. If a concern deals with local market, a seasonal product or

perishable goods, then sole-trade business will be suitable. The capital requirements of such concerns will be less and scale of operations will be low. On the other hand, if the concern caters to large markets and the scale of operations is large, then company form of organisation will be useful. If the primary aim of a concern is to serve its members, then a co-operative society will be most suitable

8. Relationship between Ownership and Management. There is a direct relationship between ownership and management in sole- trade concerns and partnership firms. In company form of organisation, management and ownership are in two different hands.

The owners (shareholders) are spread all over the country and they do not take active interest in the working of the enterprise. Moreover, shareholders cannot participate in the day-to-day activities of the concern. The management is in the hands of few persons known as Board of Director. When the investors want to retain management in their own hands, then partnership or sole-trade form of organisation will be suitable.

If the investors do not have much time for the business and they want to make investment only then company form of organisation will be suitable. If the investors do not have much time for the business and they want to make investment only then company form of organisation will be suitable.

9. Ease in Formation. The nature and extent of formalities required at the time of establishing a concern also influence a decision about the form of organisation. A joint stock company requires the services of qualified persons for getting it registered.

It involves a lot of money at the time of incorporation too. On the other hand, a sole-trade business can be started at any time without going through various formalities. If the owners are not ready to go through various formalities they cannot start a company.

10. Flexibility. A good form of organisation should also provide for flexibility in its operations. It should be possible to change or adjust its operations with the change in circumstances.

A sole- trading concern is more flexible than a partnership or a company in operation. A sole-trader has absolute power over the affairs of his business and is able to introduce changes quickly to meet the needs of changing time and situations without involving expenditure.

11. Stability. Another important factor that influences the choice of a suitable form of organisation is the continuity and stability of its operations. The discontinuation of business causes wastage of resources and inconvenience to the consumers.

This also causes a social loss. The company form of organisation offers the maximum stability or continuity as it is not affected in any way by the death or insolvency of its members. On the other hand, a sole-trading business comes to an end on the inability or death of the proprietor.

A partnership firm also suffers from the uncertainty of duration because it can be dissolved at the time of death, lunacy or insolvency.

Conclusion:

Selecting a suitable form of business organisation is a very important decision as it is very difficult to change the form of organisation later on. We have mentioned above the factors that the form of organisation. All these factors have to be balanced against each other as no single factor can determine an ideal form of organisation.

This decision should not only be based on present considerations but future possibilities should also be taken into account. Broadly speaking. sole-trader for small business, the partnership firm for medium business and the company form of organisation for big business is the most suitable form of business organisation.